We’ll look at how you currently structure and manage your finances and assets, then suggest improvements that may range from minor recommendations to implementing an entirely new system. After that, we’ll check in with you, answer any questions you may have and make ongoing suggestions to ensure your system serves your community well.

We’ll help you develop and maintain a comprehensive budget that lets you see the financial picture of your community on a single page, giving you a snapshot of where you are and where you’ll be at year-end. Not only will your budget show you how each program and project fits into the bigger picture, we’ll also give you the tools you need to monitor your finances and make day-to-day decisions.

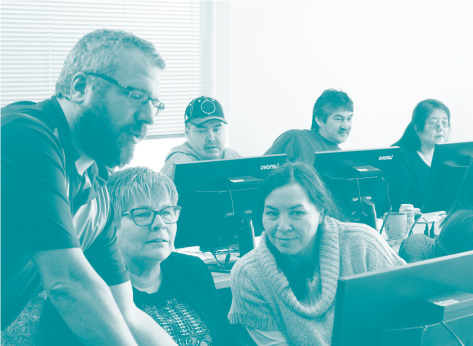

If you need a professional accounting partner to consult with for training and financial advice, we can help. We can give you advice on best practices or technical help with accounting software. We can also implement networked accounting solutions with offsite backup services or install computer networks and workstations for your community’s administrative office.

The best way to recover from debt is to tackle it head on with a well thought-out plan. We’ll help your community build a sound, effective debt-recovery plan that’s tailored specifically to your circumstances so you can get ahead and stay ahead financially.

We offer assessment, installation, training and technical assistance for accounting and payroll software that will help make doing payroll worry free. We’ll recommend and implement new accounting systems and payroll solutions, or replace outdated or existing ones. We specialize in offering secure, online payroll solutions for First Nations communities.

Capital projects can be exciting and daunting at the same time. We’ll help you navigate the financial waters of your capital project, from planning the budget to doing the administration work and monitoring its progress. If you need it, we can also help you negotiate with Federal or Provincial agencies or financial institutions to secure funding.

If you need occasional assistance or advice about a loan for your community, we can help you with planning, application, negotiation and follow up. If you want us to assess your loan requirements within your community’s bigger financial picture, we can help with that too.